After reading The Bitcoin Standard and its companion book The Fiat Standard by Saifdean Ammous, you begin to reflect on the incredible change that is coming ushered in by Bitcoin. In this new world, we are going to have to unlearn a lot of things that we have learned and begin to look at many things in a completely different way. Here’s my top 10 list of major mind shift changes in a Bitcoin world:

Monetary Sovereignty: In a Bitcoin world, individuals have full control over their money. They can store and transfer value without relying on centralized institutions like banks. Bitcoin allows users to be their own bank, providing greater financial autonomy and reducing the risk of censorship or confiscation. This is a big deal because today, we are taught that we should have someone else handle our money for us (banks and other financial institutions, financial advisors, etc.). What’s worse, we are taught that we might lose our money if we hold on to it or manage it ourselves and that basically, we can’t be trusted with our own money. That’s just silly.

Example: With Bitcoin, individuals can send and receive money directly without needing permission from any intermediaries. They can also choose to store their wealth in a non-custodial wallet, where they control the private keys, ensuring full control over their funds.

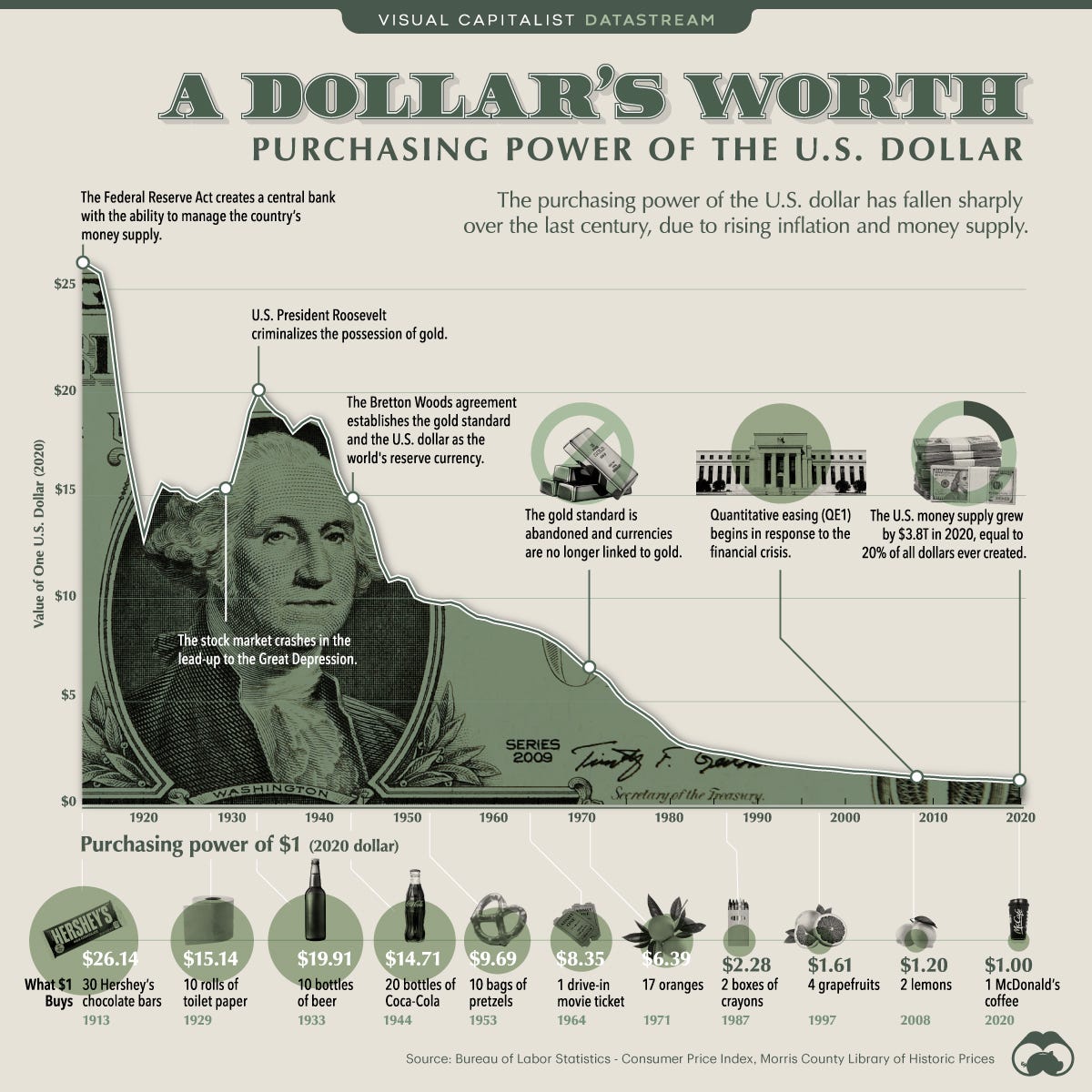

Sound Money Principles: Bitcoin embodies sound money principles, which make it a reliable store of value. These principles include scarcity, divisibility, durability, and portability. Bitcoin's scarcity is defined by its limited supply, ensuring that it cannot be inflated or devalued arbitrarily. We are so used to having inflation that we can’t comprehend what a sound money is and this has also messed up pricing of everything. The things we need such as gas, food, housing cost more every year. We think we are great investors, but the assets we buy are not really going up in value in fiat terms. Instead, it’s the fiat that is going down in value and depending on the asset, it may or may not be keeping up with that level of debasement.

Example: Bitcoin's fixed supply of 21 million coins ensures that it is not subject to the inflationary pressures that fiat currencies face. This scarcity makes Bitcoin a hedge against the erosion of purchasing power over time.

Decentralization: Bitcoin operates on a decentralized network, meaning there is no central authority governing its transactions. This decentralization enhances security, censorship resistance, and resilience against manipulation. This is also a big deal because as the fiat system begins to fail, the natural reaction is for government to want more centralization to maintain control (i.e., Central Bank Digital Currencies, fewer / bigger banks, more surveillance, less freedom, etc.).

Example: Bitcoin's decentralized nature is demonstrated through its distributed network of nodes and miners globally. No single entity has control over the entire network, making it difficult for any single entity to manipulate the system.

Trustless Systems: Bitcoin's design is based on trustless systems, meaning users do not need to rely on trust in intermediaries. Instead, they rely on cryptographic algorithms and consensus mechanisms to verify transactions and maintain the integrity of the network.

Example: Bitcoin's proof-of-work consensus mechanism ensures that transactions are validated by miners, who compete to solve computational puzzles. This eliminates the need to trust a central authority to verify transactions, making the system more secure and transparent.

Economic Incentives: Bitcoin's economic incentives are aligned to encourage responsible behavior and value preservation. Miners are rewarded with newly minted Bitcoin and transaction fees, while the limited supply of Bitcoin ensures that its value can appreciate over time.

Example: Miners expend computational power and resources to secure the network and validate transactions. In return, they are rewarded with newly created Bitcoin and transaction fees. This incentivizes miners to act in the best interest of the network's security and stability.

Voluntary Adoption: Bitcoin's adoption should be voluntary and based on individuals' understanding and acceptance of its properties and benefits. It should not be forced upon anyone through coercion or mandates. We are already seeing a lot of Bitcoin adoption globally that is really being driven by a grass roots movement. El Salvador is an example of a nation state adopting Bitcoin - still, they do not require individuals to use it and only require businesses to accept it (customers still have the option of using US$ if they want to). I wrote an update on Bitcoin adoption a couple of weeks ago in case you missed it:

Example: In a Bitcoin world, individuals have the freedom to choose whether to adopt Bitcoin as a means of storing and transferring value. Governments or institutions should not impose its use but rather allow individuals to decide based on their assessment of its benefits.

Financial Privacy: Privacy is a crucial aspect of financial transactions in a Bitcoin world. Users should have the ability to protect their personal data and transactional information from unauthorized access. For the reasons discussed above regarding decentralization, privacy is more important than ever but will be challenged by governments in the coming years seeking to control the financial system and ultimately, individuals.

Example: Bitcoin transactions are pseudonymous, meaning that while transaction details are public on the blockchain, the identity of the users involved is not directly linked to those transactions. Users can also employ additional privacy-enhancing technologies, such as coin mixing or privacy-focused wallets, to enhance their financial privacy further.

Austrian Economics: Bitcoin's philosophy aligns with the principles of Austrian economics, which emphasize the importance of market forces, spontaneous order, and the absence of central planning. I wrote about how Austrian Economists, Libertarians and Bitcoiners have a lot in common here:

Example: Bitcoin operates in a decentralized market, where its price is determined by supply and demand dynamics. The absence of central authority and market manipulation ensures that Bitcoin's value is determined by a free market, allowing for more organic and efficient price discovery.

Technological Innovation: Bitcoin's underlying technology, blockchain, has transformative potential beyond digital currencies. It enables secure and transparent record-keeping, which can be utilized in various sectors such as supply chain management, voting systems, and decentralized finance.

Example: Blockchain-based supply chain solutions can provide transparent and verifiable records of product origins, ensuring the authenticity and traceability of goods. Blockchain-based voting systems can enhance the security and integrity of elections, reducing fraud and increasing trust in the democratic process.

Many decentralized and trustless technologies have emerged, inspired by the principles and innovations of Bitcoin. Here are a few notable examples:

IPFS (InterPlanetary File System): IPFS is a distributed protocol that aims to revolutionize file storage and sharing on the internet. It uses a decentralized peer-to-peer network to create a content-addressable, versioned file system. IPFS enables data to be stored and retrieved in a trustless and efficient manner, improving data availability and resilience.

Lightning Network: The Lightning Network is a layer-2 scaling solution built on top of Bitcoin. It allows for faster and cheaper transactions by enabling off-chain micropayments that can be settled on the Bitcoin blockchain. The Lightning Network enhances Bitcoin's scalability while preserving its security and decentralization.

Decentralized Identity (DID): Decentralized identity solutions aim to provide individuals with ownership and control over their digital identities. Inspired by Bitcoin's principles of decentralization and self-sovereignty, DID systems utilize blockchain technology to create verifiable and tamper-proof digital identities, reducing reliance on centralized identity providers.

Nostr (Notes and Other Stuff Transmitted by Relays): Perhaps one of the most significant recent developments in decentralized, trustless technology inspired by Bitcoin is Nostr. Here’s a little more on it:

Client-Relay Model: Nostr operates using a client-relay model. Each user runs a client, which can be a native client or web client. Users write posts, sign them with their cryptographic keys, and send them to multiple relays (servers) hosted by various individuals or themselves.

Decentralized and Resilient: Nostr doesn't rely on any trusted central server, ensuring resilience against censorship or shutdowns. Users publish their posts to multiple relays, allowing their content to be distributed across the network.

Tamperproof: All posts in Nostr are signed with cryptographic keys and validated on the client side. This ensures that the posts remain tamperproof and authentic.

Relays: Relays in Nostr are simple and dumb. They accept posts from some users and forward them to others. Relays don't communicate with each other, only with users. Anyone can run a relay, and relays don't need to be trusted.

Ban and Migration Resilience: If a user gets banned from a relay, they can still publish to other relays, preserving their identity and follower base. Users can publish server recommendations to inform followers of their new relay in case of migration or bans.

Censorship-Resistance: Users can publish their updates to multiple relays, and relays can charge fees or implement authentication mechanisms to prevent spam and ensure censorship-resistance. Users have the flexibility to choose relays based on their preferences.

Data Storage: Nostr can function effectively with a relatively small number of active relays. New relays can be easily created and spread through the network, ensuring data availability. The storage requirements are generally lower compared to other social networking solutions.

Video and Heavy Content: Relays can reject large content or charge for accepting and hosting heavy content. Market forces and incentives can address the challenges associated with hosting and distributing resource-intensive content.

Nostr aims to address the limitations of existing social networking platforms like Twitter, Mastodon, and Secure Scuttlebutt (SSB) by combining the benefits of decentralized, censorship-resistant networks with a simplified and resilient protocol. The protocol specification and a list of software built using Nostr can be found on the project's GitHub repository.

Long-Term Thinking: Bitcoin encourages a shift towards long-term thinking regarding the value of money and investments. Its scarcity and predictable monetary policy discourage short-term speculation and promote wealth preservation over time. This is also know as time preference. Fiat systems encourage a high time preference: spend your money now, live it up, don’t take care of your health, immediate gratification, flex for your friends with your fancy clothes/car/house, etc. The Bitcoin system encourages a low time preference: work hard, save your money in Bitcoin, learn patience, live simply, exercise regularly, eat well, focus on family and loved ones and plan for the future and your legacy.

Example: Rather than focusing on short-term price fluctuations, Bitcoin holders are encouraged to view it as a long-term store of value. This mindset aligns with preserving wealth and hedging against the potential devaluation of fiat currencies over time.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

»»»»»» Twitter | Youtube | Citadel21.com | Crypto News | Cryptoqed ««««««