Bitcoin, Inflation, and the Fallacy of Cherry-Picked Timeframes

By Bitcoin Fortress - Nick Reichert

A meme has been circulating recently claiming that Bitcoin never actually broke $100,000 when adjusted for inflation. The implication is clear: Bitcoin failed as a store of value, and the price celebration was an illusion.

At first glance, the argument sounds sophisticated. Inflation adjustment is real. Purchasing power matters. Serious investors should think in real terms, not nominal ones.

But when you zoom out — even modestly — the meme collapses under its own assumptions.

The core trick behind the meme

The claim depends on three quiet choices that rarely get mentioned:

A cherry-picked starting point (2020)

A single lump-sum purchase assumption

A snapshot view of a highly volatile, monetizing asset

Change any one of those, and the conclusion falls apart.

Change all three, and the meme becomes meaningless.

Why starting points matter (a lot)

If you start your clock in 2020:

You conveniently capture a period of unusually high CPI inflation

You ignore Bitcoin’s earlier adoption phase

You exclude entire market cycles that preceded pandemic-era money printing

This is equivalent to evaluating Amazon only from the dot-com crash forward — or gold only from its 1980 peak.

Timeframe selection isn’t neutral. It’s the argument.

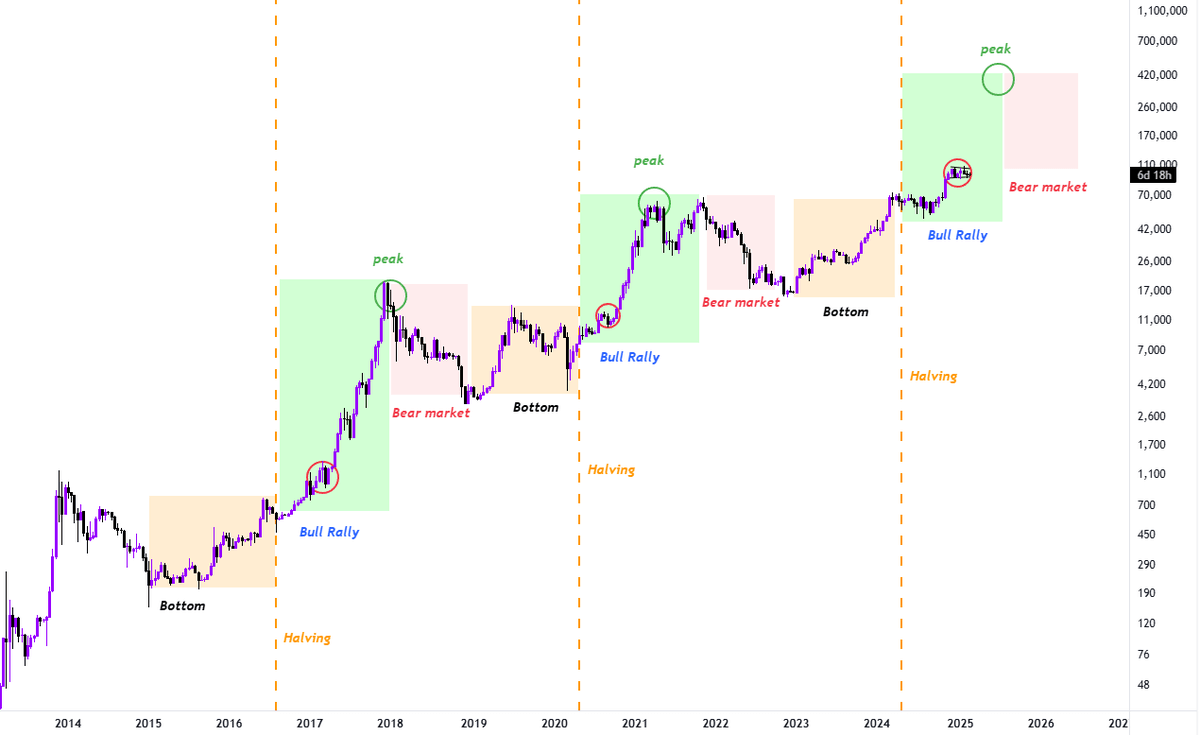

Zooming out: Bitcoin vs inflation since the 2017 cycle

A more honest comparison starts at a full market cycle, not a hand-picked macro event.

From late 2017 to today:

U.S. CPI is up roughly 30–35%

Bitcoin is up multiple times over, even when measured from prior cycle highs

Even worst-case entrants (those who bought near the top and kept buying) are still solidly positive in real terms

This matters because 2017 represents something important:

Bitcoin transitioning from obscure to globally visible.

The flaw in “inflation-adjusted snapshots”

The meme treats Bitcoin like a savings account:

One deposit

One withdrawal

No volatility in between

But Bitcoin doesn’t work that way — and never has.

Bitcoin is:

A monetizing network

A volatility-absorbing asset

A system that rewards time, not timing

Anyone who actually lived through multiple Bitcoin cycles knows this intuitively:

You don’t buy once and forget

You accumulate unevenly

You survive drawdowns

Your cost basis reflects conviction, not perfection

Real users don’t experience Bitcoin as a single data point.

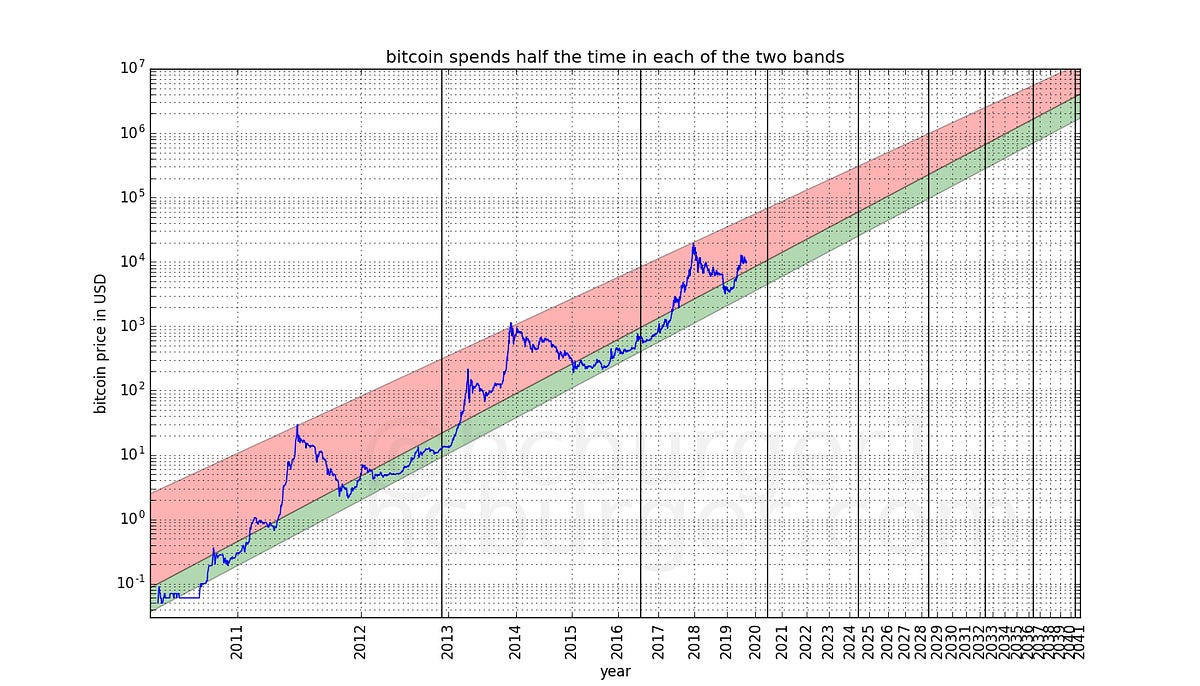

Inflation adjustment cuts both ways

If inflation adjustment is the standard — then it must be applied consistently.

That means acknowledging:

Cash lost ~30%+ purchasing power since 2017

Bonds delivered flat-to-negative real returns

Most “safe” assets quietly failed their inflation test

Bitcoin, by contrast:

Preserved purchasing power

Increased it meaningfully

Did so without bailouts, yield promises, or counterparty risk

Even under conservative assumptions, Bitcoin passed the real-return test that most legacy assets failed.

The uncomfortable truth the meme avoids

Here’s what the meme doesn’t want to admit:

Bitcoin doesn’t need perfect timing to work.

It doesn’t require:

Buying the exact bottom

Avoiding all tops

Predicting CPI prints

It only requires:

Participation

Time

Conviction through volatility

And when judged across full cycles — not social-media timeframes — Bitcoin continues to do what it has always done: outpace monetary debasement.

Final thought: inflation-adjusted honesty

Adjusting for inflation is the right instinct.

But honest inflation adjustment requires:

Full cycles

Realistic behavior

Context, not snapshots

When you apply those standards consistently, the meme doesn’t reveal Bitcoin’s weakness.

It reveals the weakness of arguments that can only survive when you stop the clock at exactly the right moment.

Fix the timeframe, and the conclusion fixes itself.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2025.

Bitcoin Fortress Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Also, check out my books available in multiple formats:

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Published in Bitcoin Fortress – Building one block at a time.

»»»»»» Twitter | Youtube | Citadel21 | PlebUnderground Swag Shop »»»»»»